Securing your company is crucial for its longevity and prosperity. One often overlooked aspect of this process is obtaining comprehensive roofing insurance. A robust roofing insurance policy offers vital coverage against unforeseen events such as storms, hail damage, or even negligence. When seeking quotes, be sure to contrast multiple insurers to find the most cost-effective option that meets your specific needs.

- Don't overlook the importance of roofing insurance in protecting your business.

- Obtain quotes from several providers to compare coverage and rates.

- Ensure the policy encompasses a wide range of potential risks, such as wind damage, hailstorms, and liability.

Securing Your Investment: Roofing Contractor Insurance

A sturdy roof is a crucial layer of protection for your home or business. But even the most robust roofing system can fall victim to unforeseen circumstances like storms, accidents, or faulty installations. This is where roofing contractor insurance becomes essential. It extends financial coverage for both you and the contractor, ensuring that any unexpected issues are addressed effectively and without burdening undue economic stress on either party.

A solid roofing policy should encompass various categories of coverage, such as:

* Liability protection

safeguarding against property damage

* Workers' compensation to compensate work-related injuries for the contractor's employees.

By securing the right roofing contractor insurance, you can have peace of mind that your investment is safeguarded against potential risks and challenges.

Get A Free Roofing Insurance Quote Today!

Are you searching for reliable roofing insurance coverage? Stop your search here We offer competitive quotes which meet your specific needs. Our team of experts is available to help you discover the perfect policy without breaking the bank.

Don't wait, by clicking here:

Small Business Roofing Insurance: Essential Coverage for Peace of Mind

Owning a small business is a rewarding undertaking, but it also comes with its fair share of challenges. Ensuring roofing insurance adjuster your business against unforeseen situations is crucial for long-term prosperity. One often overlooked aspect of risk management is roofing insurance.

A dedicated roofing insurance policy provides vital safeguard against a range of potential issues that can affect your business property. From severe weather conditions like hail, wind damage, or even falling objects, to leaks and structural issues, a comprehensive roofing insurance policy can help you survive these challenges without crippling financial burden.

By purchasing small business roofing insurance, you are showing a proactive measure towards safeguarding your investment and peace of mind.

Understanding Roofing Insurance Rates: Factors That Matter

Securing suitable roofing insurance is crucial for residential and business property owners. Numerous factors influence your premium costs, so understanding them can help you secure the best coverage at a affordable price. Location, reflecting climate risks like hailstorms or hurricanes, plays a major role. The duration of your roof and its substance also matter. A newer roof made of durable components will likely result in diminished premiums compared to an older, more vulnerable roof.

Furthermore, your financial history can affect your rates. Choosing a comprehensive policy with increased coverage limits will naturally raise your premium.

- Assess your existing policy regularly to ensure it still meets your needs.

- Request estimates from multiple insurers to compare coverage and pricing options.

The Ultimate Guide to Roofing Insurance for Contractors

Navigating the world of roofing insurance can be tricky, especially when you're a contractor dedicated to providing top-notch service. Knowing the nuances of roofing insurance is essential for protecting your business from unexpected risks and financial burdens. This comprehensive guide will walk you through the fundamentals of roofing insurance, equipping you with the knowledge required to make wise decisions for your roofing enterprise.

- Common Roofing Insurance Coverage Types

- Rewards of Adequate Roofing Insurance

- Considerations Affecting Your Premium Rates

- Choosing the Right Roofing Insurance Provider

Roofing Liability Insurance: Safeguarding Your Reputation

In the dynamic roofing industry, reputation is paramount. A single situation can swiftly damage your hard-earned reputation, leading to lost business. That's where roofing liability insurance comes in. This essential coverage acts as a critical safeguard against financial losses arising from accidents, property harm, or allegations made against your business. By securing this crucial protection, you can operate with peace of mind knowing that your company is shielded from the potentially severe consequences of unforeseen events.

It's not just about mitigating financial risk; roofing liability insurance also signals your commitment to professionalism and customer well-being.

Protecting Your Investment: Top Roofing Insurance Companies Compared

When it arrives to safeguarding your home's most vital layer, choosing the right roofing insurance can feel overwhelming. Countless companies offer coverage, each with its individual benefits and drawbacks. To help you traverse this complex landscape, we've compiled a thorough comparison of the top roofing insurance providers in the arena.

We'll analyze factors such as coverage options, track record, customer support, and costs to empower you in making an informed decision.

Whether you're encountering a new roof installation, repairs due to destruction, or simply seeking peace of mind, this guide will offer valuable insights to help you ensure your roofing investment is adequately covered.

Let's dive into the world of roofing insurance and discover which company best fulfills your needs.

ul

li Consider Coverage Options Carefully

li Investigate Company Reputation

li Prioritize Customer Service

li Compare Pricing Structures

Crucial Protection: General Liability and Workers' Compensation for Roofers

Roofing can be a demanding job, putting roofers at danger of both on-the-job injuries and claims from clients. That's why it's absolutely vital to have the right insurance coverage in place. Two types of policies are particularly crucial: general liability and workers' compensation.

General liability insurance helps protect your roofing business from lawsuits arising from property damage or bodily injury that happens during a job. This could include anything from a dropped tool damaging a client's roof to a worker causing harm themselves while on the job. Workers' compensation insurance, on the other hand, provides economic support to employees who experience injuries or illnesses on the job.

Having both types of coverage is crucial for any roofing business working. It helps protect your business from financial ruin, while also ensuring that your employees are taken care of in case of an accident. Talk to an insurance professional today to discuss the best coverage options for your unique needs.

Get Roofing Insurance Quotes and Save Money

Shopping around for roofing insurance can appear overwhelming, but it's a crucial step in protecting your biggest investment. Before you agree on a policy, take the time to contrast quotes from multiple insurers. Each company features unique coverage options and pricing structures, so a little examination can go a long way in finding the best deal for your needs.

- Gather quotes from at least three different roofing insurance providers.

- Thoroughly review the coverage aspects of each quote, paying attention to policy limits, deductibles, and exclusions.

- Avoid simply choosing the cheapest option. Consider the overall value and trustworthiness of the insurer.

Be aware that your roofing insurance needs may vary depending on your roof's age, materials, and location.

Understanding Roofing Insurance for Small Businesses Made Easy

Protecting your small business from the unexpected can be tricky, especially when it comes to roofing damage. However, with a little understanding, navigating roofing insurance doesn't have to be stressful.

First, confirm your current policy provides adequate coverage for roof repair. Check the terms carefully. Consider adding comprehensive coverage if necessary.

Don't be afraid to speak with your insurance agent to clarify any questions or concerns.

- Regularly assess your roof for potential issues and document them thoroughly.

- Service your roof consistently to reduce damage and likely claims.

- Be aware about common roofing problems in your area and take proactive steps to avoid them.

By following these simple tips, you can successfully navigate the world of roofing insurance and ensure your small business is covered in case of unexpected events.

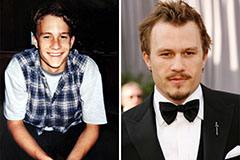

Heath Ledger Then & Now!

Heath Ledger Then & Now! Bo Derek Then & Now!

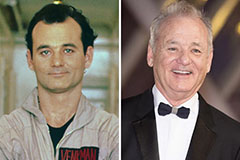

Bo Derek Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Nadia Bjorlin Then & Now!

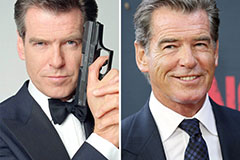

Nadia Bjorlin Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!